The 21st century is one of the great thing that have never happen to mankind because one of the great platform that was discovery with mystically enchanted the people of this present generation with some astounding features which have made our quotidian life activity very more facile and simple for us. with the help of Expediting digitalization, more expeditious Internet transmission speeds, perpetual accumulation of distributed computing resources, the application of mathematic and cryptographic technologies in the digital era: these are the factors that lead us to prognosticate that in the future, we will optically discern an underlying public chain predicated on the features of Blockchain (including but not circumscribed to: decentralization, openness, autonomy, irreversibility, and privacy bulwark). This underlying public chain will be utilized for distributed credit reporting, debt registration,wealth management, and asset transactions. It will enable business participants in different countries and regions around the world to provide financial accommodations in a much more convenient way. An incipient type of virtual agency predicated on blockchain technology—"Distributed Banking"— will emerge. A Distributed Bank is not a traditional bank, but rather an integrated ecosystem of distributed financial accommodations.

Vision and Mission

Distributed Credit Chain (DCC) is the world's initially dispersed saving money open blockchain with an objective to set up a decentralized environment for budgetary specialist co-ops around the globe. By engaging credit with blockchain innovation and returning responsibility for to people, DCC's central goal is to change distinctive monetary situations and acknowledge genuine comprehensive back.

Distributed Credit Chain (DCC) is the world's initially dispersed saving money open blockchain with an objective to set up a decentralized environment for budgetary specialist co-ops around the globe. By engaging credit with blockchain innovation and returning responsibility for to people, DCC's central goal is to change distinctive monetary situations and acknowledge genuine comprehensive back.

What is the problem

Banks everywhere throughout the world made their own authenticity with blackjack and… doesn't make a difference. Influence is a cash and individuals who got them genuinely expeditious comprehended that they can manage the world. When somebody requires mazuma, he is endeavoring to discover a chance to get an advance, yet here are a ton of points of interest of the arrangement:

.the assention ought to be ascertained by law;

.installment ought to be settled;

.connections between sides ought to be adaptable.

This is the expedient by which banks emerged. Yet, let us get some information about the cutting edge framework:

.is it genuine?

.is it conceivable to state that banks work to amend individuals' lives?

The primary answer is "no". Simply acknowledge how high credit rates are. Individuals still compelled to work with banks since it is the just a single sanctioned type of an advance. Conspicuously it is conceivable to work with credit sharks, yet for this situation, there is no indemnification by any stretch of the imagination. Along these lines, the most secure way is the bank. That is the expedient by which syndication was conceived.

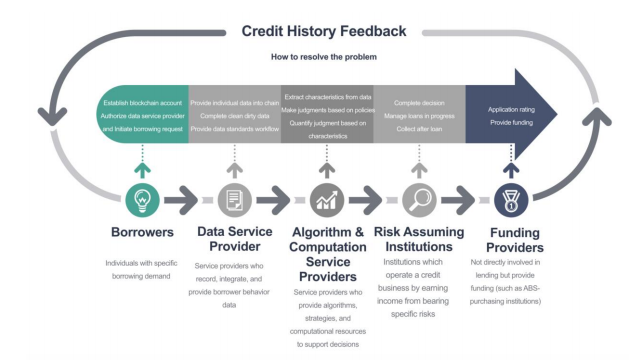

How DCC functions

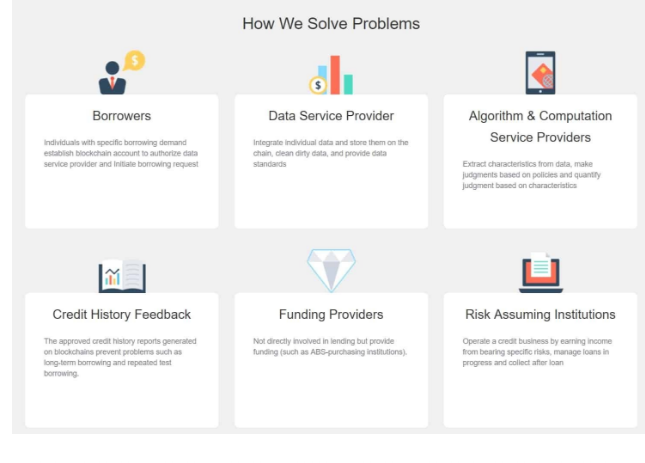

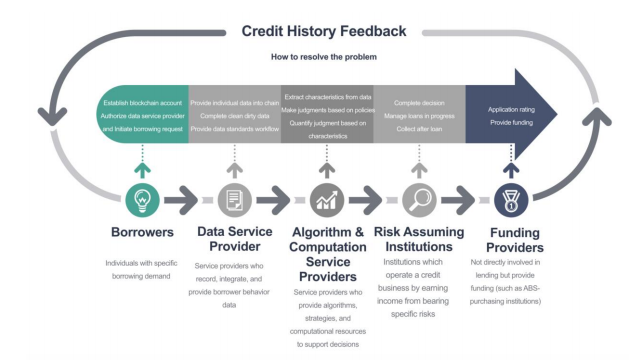

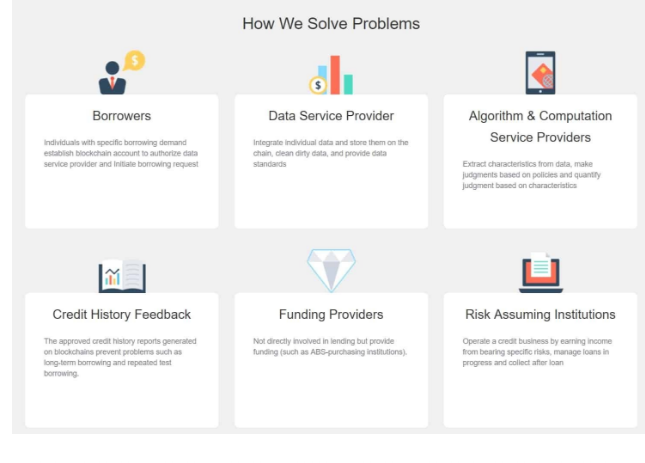

The conception of appropriated managing an account administrations is to break the imposing business model of conventional budgetary establishments into plausible monetary and return incomes from mazuma cognate administrations for all suppliers and clients with the goal that every adherent of biological community development can be energized into comprehensive financing.

Because of decentralized reasoning, Distributed Banking will have the capacity to transmute the model of participation in customary monetary administrations and make another model of sodality with companions and all media transmission organizations in all districts and segments.

To the extent business is concerned, Distributed Banking consummately transmutes the structure of the obligation, resources and mediator administrations of the conventional managing an account business, by:

Banks everywhere throughout the world made their own authenticity with blackjack and… doesn't make a difference. Influence is a cash and individuals who got them genuinely expeditious comprehended that they can manage the world. When somebody requires mazuma, he is endeavoring to discover a chance to get an advance, yet here are a ton of points of interest of the arrangement:

.the assention ought to be ascertained by law;

.installment ought to be settled;

.connections between sides ought to be adaptable.

This is the expedient by which banks emerged. Yet, let us get some information about the cutting edge framework:

.is it genuine?

.is it conceivable to state that banks work to amend individuals' lives?

The primary answer is "no". Simply acknowledge how high credit rates are. Individuals still compelled to work with banks since it is the just a single sanctioned type of an advance. Conspicuously it is conceivable to work with credit sharks, yet for this situation, there is no indemnification by any stretch of the imagination. Along these lines, the most secure way is the bank. That is the expedient by which syndication was conceived.

How DCC functions

The conception of appropriated managing an account administrations is to break the imposing business model of conventional budgetary establishments into plausible monetary and return incomes from mazuma cognate administrations for all suppliers and clients with the goal that every adherent of biological community development can be energized into comprehensive financing.

Because of decentralized reasoning, Distributed Banking will have the capacity to transmute the model of participation in customary monetary administrations and make another model of sodality with companions and all media transmission organizations in all districts and segments.

To the extent business is concerned, Distributed Banking consummately transmutes the structure of the obligation, resources and mediator administrations of the conventional managing an account business, by:

.by supplanting the matter of obligation with appropriated capital administration;

.supplanting the matter of benefits with appropriated credit revealing;

.enrollment of an obligation and supersession of a halfway business by the exchange with the disseminated resources.

The tree-like administration structure of the customary bank will advance into a caliber structure of Distributed Banking, which will establish circulated gauges for different ventures and increment the general proficiency of the business.

The Fund will dispatch the fundamental chain-the Distributed Credit Chain (DCC) to build up business norms, accomplish acquiescent on books, convey business contracts, actualize liquidation and settlement administrations, and so forth., for different disseminated mazuma cognate exchanges.

DISTRIBUTION PLAN

The Cyber Sheng Substratum expects to issue a total of 10,000,000,000 tokens of the encoded mechanized cash DCC. In the private round , accoladed qualified monetary masters in the fields of credit and sparing cash will be invited for the hypothesis, with the gregarious event promises rate near 18%, and the wander measure of single examiner no under 100ETH. At this stage, DCCs will be dashed, with 25% of the total to be opened afore the aperture of exchange, and another 25% to be opened predictably, with everything to be opened in a moiety year.

In ICO cycle, 200,000,000 DCCs will be issued to Non-Chinese and American budgetary experts. All these will be categorically streamed. DCC token will be exchanged by ETH. The obligations in the token arrangement will be held by the Distributor (or its branch) after the token arrangement, and suppliers will have no mazuma cognate or genuine straightforwardly consummated or auxiliary exhilaration for these responsibilities or the advantages of that component after the token arrangement. To the degree a discretionary market or exchange for trading DCC engenders, it would be run and worked thoroughly unreservedly of the Substratum, the Distributor, the offer of DCC and Distributed Credit Chain. Neither the Establishment nor the Distributor will make such discretionary markets nor will either substance go about as anunlocked in a moiety year

FOR MORE INFORMATION

WEBSITE: http://dcc.finance

TELEGRAM: https://t.me/DccOfficial

WHITEPAPER: http://dcc.finance/file/DCCwhitepaper.pdf

FACEBOOK: https://www.facebook.com/DccOfficial2018/

MEDIUM: https://medium.com/@dcc.finance2018

TWITTER: https://twitter.com/DccOfficial2018/

ANN THREAD: https://bitcointalk.org/index.php?topic=3209215.0

PUBLISHER DETAILS

Bitcointalk username: Timzbrand

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=2040852

UCHE CHUKWUDI TIMOTHY

Ether address: 0xC7Ee1071822E818Be0e55AefD4BD3Ea033192609

.supplanting the matter of benefits with appropriated credit revealing;

.enrollment of an obligation and supersession of a halfway business by the exchange with the disseminated resources.

The tree-like administration structure of the customary bank will advance into a caliber structure of Distributed Banking, which will establish circulated gauges for different ventures and increment the general proficiency of the business.

The Fund will dispatch the fundamental chain-the Distributed Credit Chain (DCC) to build up business norms, accomplish acquiescent on books, convey business contracts, actualize liquidation and settlement administrations, and so forth., for different disseminated mazuma cognate exchanges.

DISTRIBUTION PLAN

The Cyber Sheng Substratum expects to issue a total of 10,000,000,000 tokens of the encoded mechanized cash DCC. In the private round , accoladed qualified monetary masters in the fields of credit and sparing cash will be invited for the hypothesis, with the gregarious event promises rate near 18%, and the wander measure of single examiner no under 100ETH. At this stage, DCCs will be dashed, with 25% of the total to be opened afore the aperture of exchange, and another 25% to be opened predictably, with everything to be opened in a moiety year.

In ICO cycle, 200,000,000 DCCs will be issued to Non-Chinese and American budgetary experts. All these will be categorically streamed. DCC token will be exchanged by ETH. The obligations in the token arrangement will be held by the Distributor (or its branch) after the token arrangement, and suppliers will have no mazuma cognate or genuine straightforwardly consummated or auxiliary exhilaration for these responsibilities or the advantages of that component after the token arrangement. To the degree a discretionary market or exchange for trading DCC engenders, it would be run and worked thoroughly unreservedly of the Substratum, the Distributor, the offer of DCC and Distributed Credit Chain. Neither the Establishment nor the Distributor will make such discretionary markets nor will either substance go about as anunlocked in a moiety year

FOR MORE INFORMATION

WEBSITE: http://dcc.finance

TELEGRAM: https://t.me/DccOfficial

WHITEPAPER: http://dcc.finance/file/DCCwhitepaper.pdf

FACEBOOK: https://www.facebook.com/DccOfficial2018/

MEDIUM: https://medium.com/@dcc.finance2018

TWITTER: https://twitter.com/DccOfficial2018/

ANN THREAD: https://bitcointalk.org/index.php?topic=3209215.0

PUBLISHER DETAILS

Bitcointalk username: Timzbrand

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=2040852

UCHE CHUKWUDI TIMOTHY

Ether address: 0xC7Ee1071822E818Be0e55AefD4BD3Ea033192609

No comments:

Post a Comment