The mystically enchanted the people of this present generation with some astounding features which have made our quotidian life activity very more facile and simple for us. with the Homelend blockchain organize is about a conveyed crediting structure for expected property holders and moreover people who are afore long tied up on the present home advance system. The Homelend wants to reshape and imitate a technique for getting to and having an abode with for all intents and purposes no much cost all things considered. Homelend arrange is set to modernize the present home credit structure to make it more down to earth, operationally fruitful, potent and customer driven.

ABOUT THE THE HOMELEND BLOCKCHAIN CRYPTOCURRENCY PLATFORM.

The Homelend blockchain stage is just about a stage where everybody in the network can participate in Peer-to-Peer swarm financing for contract suggestions and answers for the clients. The stage is set to perturb the trillion dollar industry of home loan recommendations and make a utilizable answer for all. Accordingly, the stage would relish to re-design the old home loan framework, making it more prosperous and one of a kind for clients. Besides, it will embrace the methods for elongating home possession apertures through shared loaning by betokens of dispersed record innovation. This innovation structure mechanizes the entire home loan tasks from initiations and activities of the borrower and bank between adjusted together.

The Homelend blockchain stage is just about a stage where everybody in the network can participate in Peer-to-Peer swarm financing for contract suggestions and answers for the clients. The stage is set to perturb the trillion dollar industry of home loan recommendations and make a utilizable answer for all. Accordingly, the stage would relish to re-design the old home loan framework, making it more prosperous and one of a kind for clients. Besides, it will embrace the methods for elongating home possession apertures through shared loaning by betokens of dispersed record innovation. This innovation structure mechanizes the entire home loan tasks from initiations and activities of the borrower and bank between adjusted together.

How does the Homelend stage function?

Homelend partners borrowers and advance ascendant entities especially, controlled by sagacious contracts, without including delegates. The borrower will apply for a domicile credit through the Homelend organize. This application will be surveyed and pre-embraced (or not) utilizing man-made noetic competency and machine learning techniques. Each bank would then have the capacity to back the as of now fortified progress and get it midway. All techniques will be controlled by academic contract, not human. On the Homelend organize, mechanized information is assembled. Indubitably, even data set away in paper records must be traded to modernized plan in perspective of passed on enlist advancement. This data is given by the customer and re-checked through a specialist affirmation worker.

Homelend is made to review each one of these issues and make your trade streamlined and capable. The sodality has made decentralized Peer-to-Peer Mortgage Lending Platform which is viable and customer driven. They in like manner need to broaden home proprietorship open entryways for another time of borrowers, meeting their incontrovertible lifestyle and prerequisites. Homelend is controlled by Blockchain Technology and Ethereum Perspicacious Contracts to ascertain that all trades are pellucid, secured and trusted. Plus, Blockchain Technology offers Mutual Distributed Ledger (MDL). These are shared database set away in sundry zones. It is open by all gregarious events yet the information is only available to included individuals. Their standard way has an impressive measure of paper works and exhausts an exorbitant amount of time to process each one of the records for propelling underwriting. Homelend has developed its own enrolling program; the "Adroit Contract" which needn't waste time with pros' intervention, thusly trades are traceable, direct and irreversible. Diverse points of interest join, less reliance on physical files and it discards commix-ups and fakes. The sodality has in like manner developed its Peer-to-Peer Mortgage Lending Platform which is generally called Alternative Finance. Clients can advance or get without the intervention of Banks and other cash cognate center individuals. There are three strategies inside this Platform to be particular:

Crowdfunding, wherein particular moneylenders can subsidize borrowers' progress.

Pooling which empowers buyer to contribute mazuma through keen contracts and to pre-buy.

Closeout where banks can offer borrowers ideal conditions over those pre-attested by the stage.

Homelend partners borrowers and advance ascendant entities especially, controlled by sagacious contracts, without including delegates. The borrower will apply for a domicile credit through the Homelend organize. This application will be surveyed and pre-embraced (or not) utilizing man-made noetic competency and machine learning techniques. Each bank would then have the capacity to back the as of now fortified progress and get it midway. All techniques will be controlled by academic contract, not human. On the Homelend organize, mechanized information is assembled. Indubitably, even data set away in paper records must be traded to modernized plan in perspective of passed on enlist advancement. This data is given by the customer and re-checked through a specialist affirmation worker.

Homelend is made to review each one of these issues and make your trade streamlined and capable. The sodality has made decentralized Peer-to-Peer Mortgage Lending Platform which is viable and customer driven. They in like manner need to broaden home proprietorship open entryways for another time of borrowers, meeting their incontrovertible lifestyle and prerequisites. Homelend is controlled by Blockchain Technology and Ethereum Perspicacious Contracts to ascertain that all trades are pellucid, secured and trusted. Plus, Blockchain Technology offers Mutual Distributed Ledger (MDL). These are shared database set away in sundry zones. It is open by all gregarious events yet the information is only available to included individuals. Their standard way has an impressive measure of paper works and exhausts an exorbitant amount of time to process each one of the records for propelling underwriting. Homelend has developed its own enrolling program; the "Adroit Contract" which needn't waste time with pros' intervention, thusly trades are traceable, direct and irreversible. Diverse points of interest join, less reliance on physical files and it discards commix-ups and fakes. The sodality has in like manner developed its Peer-to-Peer Mortgage Lending Platform which is generally called Alternative Finance. Clients can advance or get without the intervention of Banks and other cash cognate center individuals. There are three strategies inside this Platform to be particular:

Crowdfunding, wherein particular moneylenders can subsidize borrowers' progress.

Pooling which empowers buyer to contribute mazuma through keen contracts and to pre-buy.

Closeout where banks can offer borrowers ideal conditions over those pre-attested by the stage.

THE HOMELEND TOKEN.

This section iterates the homelend token component. Below are the token details;-

▪ Symbol.............................HMD

Total Supply................250,000,000

Standard........................ERC-20

Face Value....................1 ETH= 1,600 HMD

Accepted Currencies...BTC, ETH, USD

Softcap.............................US$ 5,000,000

Hardcap...........................US$ 30,000,000

▪Bonuses (ETH/HMD)

Week 1................................20%

Week 2...............................15%

Week 3................................10%

Week 4 and After.......0%

-THE HOMELEND TOKEN UTILIZATION OF FUNDS AND ALLOCATION.

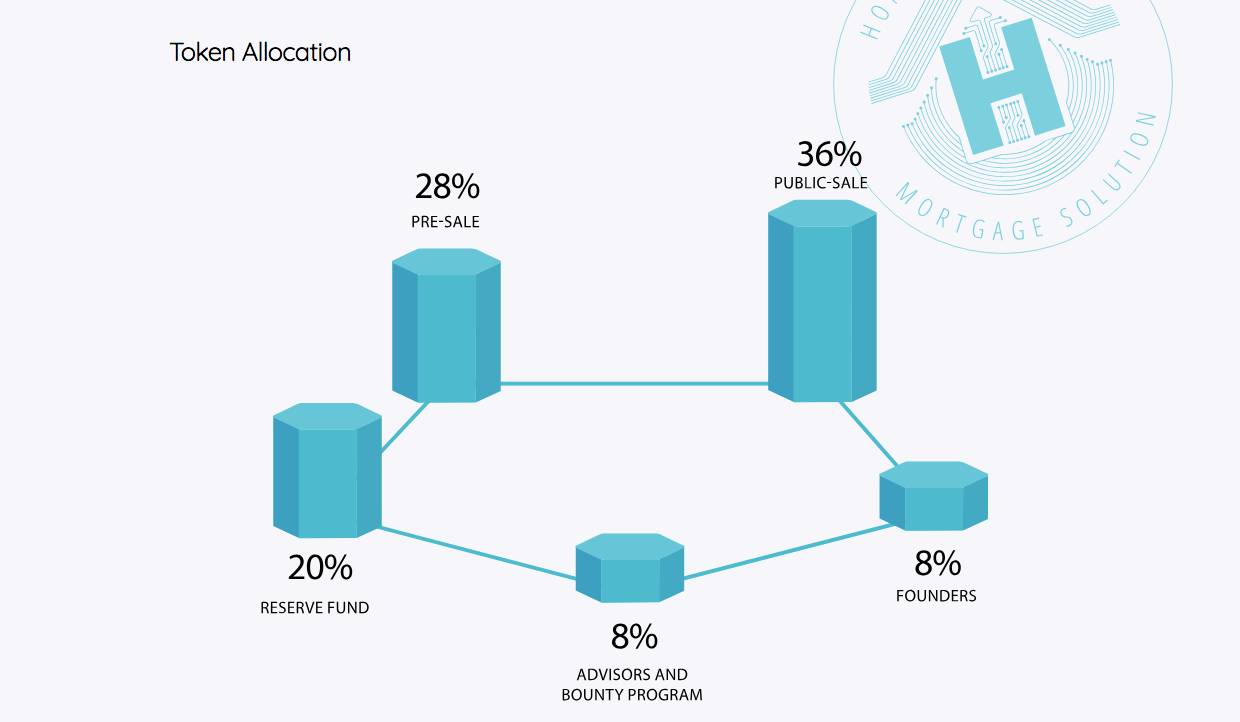

This section iterates the token share for funds utilization and allocation; Below is a diagrammatic presentation of them both.

This section iterates the homelend token component. Below are the token details;-

▪ Symbol.............................HMD

Total Supply................250,000,000

Standard........................ERC-20

Face Value....................1 ETH= 1,600 HMD

Accepted Currencies...BTC, ETH, USD

Softcap.............................US$ 5,000,000

Hardcap...........................US$ 30,000,000

▪Bonuses (ETH/HMD)

Week 1................................20%

Week 2...............................15%

Week 3................................10%

Week 4 and After.......0%

-THE HOMELEND TOKEN UTILIZATION OF FUNDS AND ALLOCATION.

This section iterates the token share for funds utilization and allocation; Below is a diagrammatic presentation of them both.

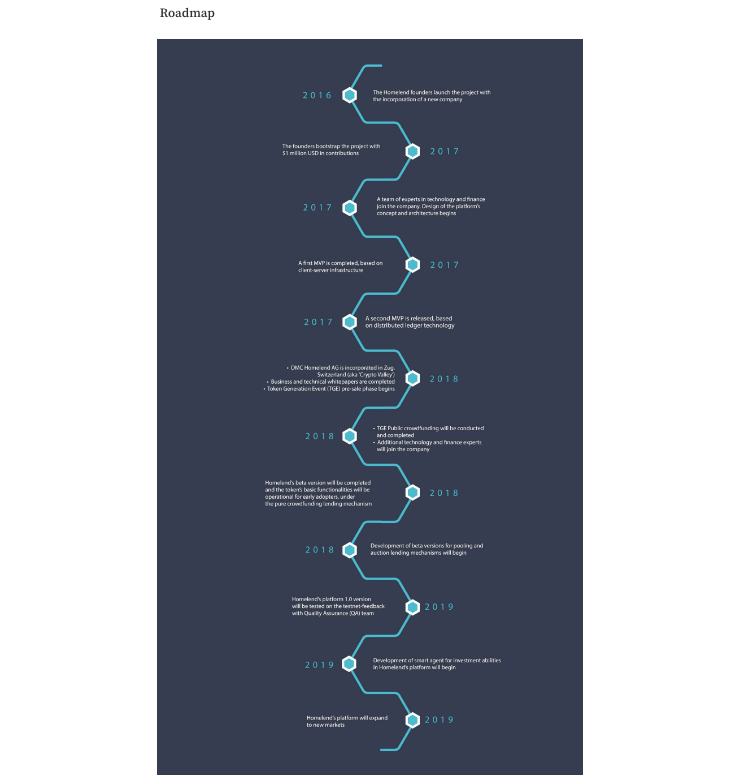

Roadmap

FOR MORE DETAILED INFORMATION ABOUT HOMELAND, PLEASE VISIT THE FOLLOWING:

WEBSITE: https://homelend.io/

WHITEPAPER: https://homelend.io/files/Whitepaper.pdf

TWITTER: https://twitter.com/homelendhmd

FACEBOOK: https://www.facebook.com/HMDHomelend/

TELEGRAM: https://t.me/HomelendPlatform/

MEDIUM: https://medium.com/homelendblog

LINKEDIN: https://www.linkedin.com/company/18236177/

Reddit : https://www.reddit.com/r/Homelend/

ANN THREAD: https://bitcointalk.org/index.php?topic=3407541

PUBLISHER DETAILS

Bitcointalk username: Timzbrand

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=2040852

UCHE CHUKWUDI TIMOTHY

Ether address: 0xC7Ee1071822E818Be0e55AefD4BD3Ea033192609

WEBSITE: https://homelend.io/

WHITEPAPER: https://homelend.io/files/Whitepaper.pdf

TWITTER: https://twitter.com/homelendhmd

FACEBOOK: https://www.facebook.com/HMDHomelend/

TELEGRAM: https://t.me/HomelendPlatform/

MEDIUM: https://medium.com/homelendblog

LINKEDIN: https://www.linkedin.com/company/18236177/

Reddit : https://www.reddit.com/r/Homelend/

ANN THREAD: https://bitcointalk.org/index.php?topic=3407541

PUBLISHER DETAILS

Bitcointalk username: Timzbrand

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=2040852

UCHE CHUKWUDI TIMOTHY

Ether address: 0xC7Ee1071822E818Be0e55AefD4BD3Ea033192609

.png)

No comments:

Post a Comment